Euronext-listed company, Yatra Capital managed by Saffron Capital Advisors, an Indian Real Estate Private Equity fund has announced to invest around 20 million Euros in India in FY10. The company plans to invest the Rs 115 cr in two deals in the domestic sector of real estate. The company has as of now invested about Rs 916 cr in 13 projects which include 2 entity-level details.

The weighted average Yatra Equity Fund covers 27 million square feet spread over nine cities. They have sold or pre let over 3 million square feet across various projects.

The chairman and Co-Founder, Yatra Capital, Mr. Christopher Wright said, “In India, one needs to be very careful on Real Estate investments as the market is volatile. After a drop in 2008-09, the realty sector is now moving up. The Indian economy is growing well making people more confident on future investments. We have invested 44% in residential projects, which would be our focus area in future. We always look at investing in affordable residential projects in tier I and II cities.”

Yatra has invested in 90 cr Residential Project and 97 cr Market City Retail Project at Pune, 115 cr in Riverbank Holdings, 91 cr in forum IT parks and 23 cr in Taj gateway at Kolkata, 160 cr in market city at Bangalore and 57 cr at Nashik.

It has entered partnership with Phoenix Mills for 5 various projects across Bangalore, Pune and Mumbai.

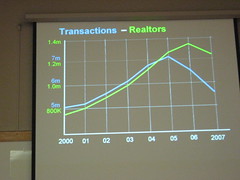

A presentation by Yatra to investors in March this year said, “Most markets have seen positive traction due to price cuts. However, developers have now started raising prices especially in Mumbai and the National Capital Region which has led to a slowdown in sales. Projects where pricing is realistic continue to enjoy healthy absorptions. The monetary environment tightening may impact the fund raising environment for many real estate companies still out to raise money. Investor enthusiasm for participation in realty IPOs remains muted.”